|

TOPLEA MACHINERY IMP &.EXP CO.,LTD

|

Gold Index: 15103

You are here: home > Poultry News > CoBank Predicts Better Year for Poultry Producers in 2016

Product (155)

- Slaughterhouse Equipment (84)

- Poultry Farming Equipment (7)

- Cold Room (19)

- Rendering Equipment (22)

- Food Processing Equipment (23)

Poultry News (81)

Industry News (34)

Lay Out Reference (1)

INTRODUCTION TO THE POULTRY PROCESSING INDUSTRY (11)

Blog (23)

Cooperation company (9)

News (10)

Credit Report

Products Index

Poultry News

CoBank Predicts Better Year for Poultry Producers in 2016

ANALYSIS - The supply glut that plagued US beef, pork and poultry markets in 2015 and ratcheted down margins is expected to ease in 2016, according to a new research report from CoBank.

Trevor Amen, Animal Protein Economist with CoBank

The bank says leading indicators point to animal protein supplies transitioning toward a state of equilibrium, with protein stocks more in line with overall levels of demand.

"It's clear that in the coming year, the headwinds and adverse conditions created by excessive protein stocks are clearing," said Trevor Amen, animal protein economist with CoBank.

"Surprisingly strong US consumer demand helped lay the groundwork for improving market conditions in the coming year, combined with the fact that the net trade balance is expected to shift toward growing exports and fewer imports. This is welcome news for US beef, pork and poultry producers."

On the Horizon

In the first half of 2016 protein exports are expected to remain somewhat of a challenge.

"But conditions are predicted to improve over depressed 2015 levels due to improving price competitiveness of US meat products," added Mr Amen.

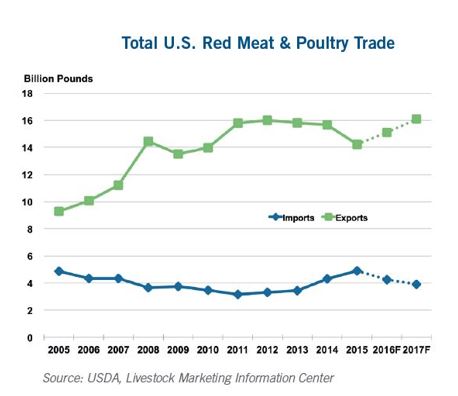

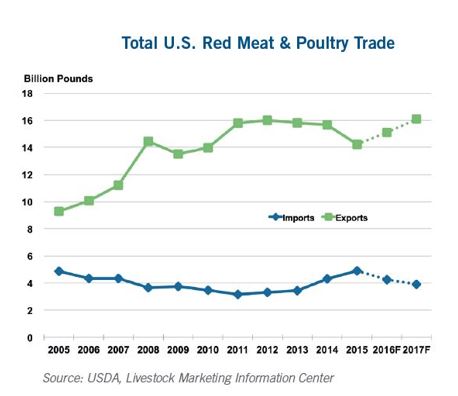

Total combined meat exports accounted for 15 percent of US production in 2015 compared to just 4 percent in 1990. Total combined meat exports fell across the board in 2015, resulting from the run-up in the value of the US dollar, retaliatory Russian sanctions on US meat exports, China's economic slowdown, HPAI related restrictions by trading partners on US exports.

At the same time, the US attracted more imports in 2015 due to a strong US dollar and drought driven beef herd liquidation in Australia. As a result of this shift in the net trade balance, US consumers had to play a greater role in clearing the market of the surge in the per capita meat supply.

Looking ahead into 2016, many analysts are projecting a reversal of the previous year's shift in the net trade balance for meat, with fewer imports and more exports. This is a bold prediction in the face of a slowing global economy and uncertainty regarding potential HPAI related trade disruptions.

It is based primarily on the currently depressed wholesale values of US meat, which have vastly improved US price competitiveness versus other key global meat exporters. However, the strong value of the US dollar will continue to be a headwind for US meat exports.

Meanwhile, imports of lean beef should slow significantly and domestic consumer demand for beef, pork and poultry is anticipated to remain strong and supportive of prices.

Supply imbalances have already begun the correction phase, with supply and demand expected to drift closer to equilibrium by about mid-year. Just how far and how fast US meat prices change in the coming months will depend critically on the resilience of protein demand.

For instance, meat demand in the restaurant sector continues to grow. The Restaurant Performance Index and the Expectation Index each indicate positive restaurant business conditions. Combined with lower gas prices, current consumer attitudes indicate a willingness to spend more at restaurants versus in-home meals during 2016.

Price outlooks are mixed:

- Pork and chicken prices have an upside potential compared to 2015's fourth quarter lows, based on adjustments made for future production.

- Beef prices will likely remain under pressure for the next two years, however, as the industry is coming off cyclical highs of 2014.

Of course, optimism for 2016 should be tempered by the oversupply lessons of 2015.

"Total red meat and poultry production set an all-time high in 2015," said Mr Amen. "Combined with fewer exports and more imports, total domestic meat supplies surged by 4.4 percent, the highest year-over-year increase in 40 years."

That increase in supply translated to an additional 9 pounds of protein per person - historically, protein supplies rose an average of 0.8 pounds per person per year from 1960 to 2015.

As the market works through the recent protein oversupply hangover, the long-term outlook remains positive, especially with continued global middle class growth.

"The increasing demand for a higher-quality diet likely provides domestic protein producers with significant opportunities in the next decade," concluded Mr Amen.

Pre Page:

IPPE: Highlights from The World's...

Next Page:

Backyard Chickens Infested with More...